What about your state?

1945:

Who Has The Lowest?

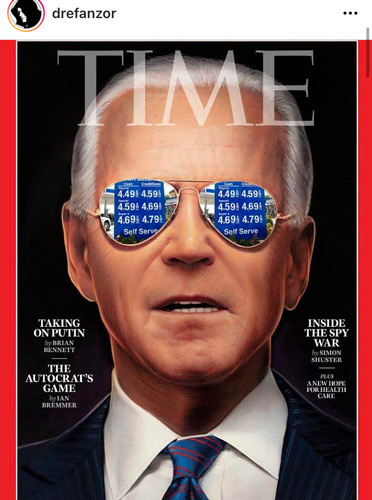

Gas prices, as any driver could tell you, have been slightly rising throughout the year. And while they remain relatively low by historical standards, they’re still higher than they were the last couple of years.

It’s also the case that the price of gas is higher in some states than others. There are a few factors in place that determine that, from proximity to refineries to supply disruptions. But one major factor in the difference in prices is gas taxes, which differ from state to state.

Kiplinger recently looked at the ten states in the U.S. with the highest gas taxes. In some cases, drivers looking for cheaper gas can even cross state lines to do so.

The highest gas taxes are in California, where the state fuel tax is 66.98 a cent per gallon. California, ironically, announced earlier this year that it will phase out sales of gasoline-powered vehicles by 2035. MORE

Texas has a 20 cent tax on a gallon of gas. Add in the Big Guy’s cut, and we pay 38.4 cents per gallon.

And we don’t even get stamps anymore….

And we don’t even get stamps anymore…

Whut? Yew mean yer not vaccinated?

Aaaaaaaaaaaannnnnnd it’s never enough to feed these hungry, greedy Cloward-Piven Socialists Hell-bent on breaking the back of America!

Composite tax in Chicago is $0.72 per gallon. That includes $0.391 per gallon which governor pritzker had doubled last year from $0.19 per gallon. Cook county and Chicago and fed included in. That number.

Gasoline — relatively low ???

Yeah, if You are comparing prices under OBama.

Certainly gas is NOT relatively low when comparing to Trump.

Just saw these VA folks ranting about gas prices. The Biden supporter is definitely the dope that thinks the gas price is high because we didn’t drive last year. Clueless.

https://www.newswars.com/watch-virginia-gas-customers-outraged-by-high-fuel-prices-its-killing-me/

….They’re not shy about telling us it’s almost 72 cents in OH, which they actually REQUIRE, guess they figure folks that let their Country get stolen by Communists have no fight in them so they get off on showing us the penis they’re raping us with…

https://www.dispatch.com/storyimage/OH/20200211/NEWS/200219734/AR/0/AR-200219734.jpg

This is why I have 75 gallons on board my truck whenever I have to drive through California; I won’t contribute to their corrupt economy. Bad enough I have to contribute to my own corrupt state.

Tony R – That 75 gallons of gas weighs about 473lbs.

Aaaaaaaaannnnnnd that’s still 1327lbs lighter than Ford’s F150 battery that gets it 300 miles of range on a good day without towing, A/C or heat!

My gas saving tip (depends on where you live): Cut your grass on the highest blade setting on your mower. Grass will try to repair itself by growing faster to shade/repair itself if you cut it short, that adds up to you cutting it more often and burning more gas. Your lawn will be more healthy, require less cutting, and will choke out more weeds if you leave it long. Come the summer months when it’s hot with less frequent rains and the grass starts to wither, longer grass will stay green longer and require less cutting (because weeds won’t take over as fast). Where I live, I haven’t cut my grass in 5 weeks and it looks just fine. That adds up to more money in my pocket and time saved. Meanwhile my neighbor cuts weekly on the super-short setting and causes a big dust storm and all he’s cutting is weeds (and dirt).

Virginia .27 for diesel

26.2 for gasoline.

Stickin’ it to commerce and anyone that tied tows big.

I’m paying 2.95 per gallon, on average I get 16-18 mpg in my F350. Long trips I get 20, but not when I’m towing the toy hauler. Goes down to 10. Usual fill up is $50. 😵 Diesel should NOT cost more than regular.

^^^ Don’t fergit to add the blue cow piss that a lot of diesels need to run these days!

Blue cow piss AKA DEF. I hate the damn stuff, thank God we have only the one diesel Isuzu for making deliveries and only when we have a large load. DEF is California mandated madness to reduce diesel emissions, every truck driver hates the damn stuff. Diesel Izuzu trucks are commonly known as Myrtle the turtle because they are so slow especially going uphill.

I’ve always called DEF “panther piss”.

Thankfully the 2015 doesn’t use a heckuva lot of it like someone’s 2021 does. I only have to fill it about 3 times a year. Regens are what get me. “Giving 1/8 of a tank to the democrats” is what I call it.

.26 here in SC, we just increased it a penny for road “improvements”.

Last year the SCDOT paved a side street, three weeks later guess what?

They paved it again.

Wash. state’s gas tax rate is nearly .68 cents a gallon so we’re up there with high gas taxes as well.

Don’t forget to add your state and local SALES TAX to the total extortion damage.

In Florida, add .24/gal state FUEL tax (.28 for diesel) to the feddle tax, and THEN add from 6% to 7.5% SALES tax (varies by local tax district, I pay 7% in Sarasota County). In case it isn’t obvious, you pay sales tax on what you spend on fuel tax.

Whoo hoo! I’m in the second lowest tax per gallon state. And the second lowest tax per pack of cigarettes!

However, we are burdened with St. Louis and Kansas City, so it kind of balances out.

Bummer…..

When i was young we were paying about 25 cents a gallon.

Now in Canada we pay about %5.00 a gallon,yet we have more oil than almost any country on the planet.

Explain.

Alexb – Yer Pols are very rich!