The IRS on Friday announced that contribution limits for 401(k) plans and Individual Retirement Accounts (IRAs) are rising in 2023 in response to price inflation that’s running at the fastest pace in about 40 years.

The limits are linked to the headline Consumer Price Index, or CPI-U, and September’s reading saw an 8.2% year-over-year increase.

The boost to the 401(k) maximum is the biggest one ever in both dollar and percentage terms, as retirement investors will be able to contribute $2,000 more in 2023 than they can this year. The limit on so-called “catch-up contributions”– available to those age 50 and over — is rising by $1,000, to $7,500.

That puts 2023’s annual 401(k) limit at $22,500 for workers under 50, and $30,000 for those 50 and older. The same new maximums apply to participants in 403(b) and most 457 plans, as well as the Thrift Savings Plan for federal government employees.

IRA investors will be able to put away an extra $500 in 2023, as the limit rises to $6,500. Unlike most other contribution amounts, the IRA “catch-up” for the 50+ crowd isn’t indexed to inflation and will remain at $1,000. more here

Buy the dip, the only question is how low can Joe go?

And with the increased cost of energy, food and everything else who can put money away?

FJB

Great, put more money into a retirement account so Biden can vaporize it with inflation…no thanks.

of COURSE Pedo wants you to put more money in your retirement account.

More for him to steal.

https://www.401krollover.com/401k-nationalization-possibility/

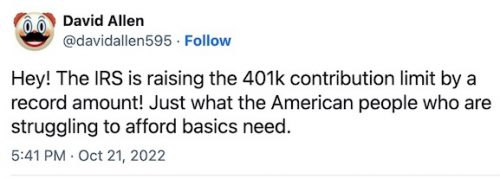

Who but a few can take advantage of it with the economy as it is?